lake county sales tax rate 2021

91 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Lake Forest Park.

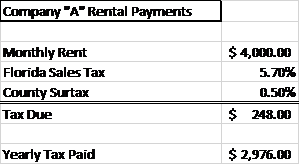

How To Calculate Fl Sales Tax On Rent

Method to calculate Lake County sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

. Metropolitan park district lake metroparks lakeland community college board of developmental disabilities deepwood or a total of 36049 would be deducted from the 325038 amount which equals a net tax of 285899 the non-business and owner occupancy factors will be on your tax find your appropriate taxing district on the chart. You can find more tax rates and allowances for Lake County and Florida in the 2022 Florida Tax Tables. How Does Sales Tax in Lake County compare to the rest of Florida.

This is the total of state and county sales tax rates. These rates are weighted by population to compute an average local tax rate. If you have questions or concerns please call the Treasurers Office at 847-377-2323.

Please refer to the following links if you are a business owner and need to learn more about obtaining a sales tax permit or making tax-exempt purchases for resale. 1717 036 065101 Lake Stevens. Look up the current sales and use tax rate by address Data Last Updated.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. Income Tax Rate Indonesia. There was legislation to reduce the rate to 54 in 2021 but the legislation was never enacted because the economic tsunami of Covid-19 started to hit while the legislation.

1788 rows California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. The longer time between the sale and redemption the higher the penalty is likely to be. Pend Oreille County Sales and use tax within all of Pend Oreille County will increase one-tenth of one percent.

The Lake County sales tax rate is. Lake County Sales Tax Rate 2021. The California state sales tax rate is currently 6.

Restaurants In Matthews Nc That Deliver. A City county and municipal rates vary. The tax will be used for housing and related services.

State Local Sales Tax Rates As of January 1 2021. Majestic Life Church Service Times. The Lake County Sales Tax is collected by the merchant on all qualifying sales made within Lake County.

Lake County CA Sales Tax Rate The current total local sales tax rate in Lake County CA is 7250. State and Permissive Sales Tax Rates by County April 2022 Municipalities whose boundaries extend both within and beyond Franklin County assess a transit rate of 050 in addition to the posted state and county sales. Lake County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Lake County totaling 1.

The 2018 United States Supreme Court decision in South Dakota v. The December 2020 total local sales tax rate was also 0000. Soldier For Life Fort Campbell.

Essex Ct Pizza Restaurants. For footnote information please see the bottom of page 5. Local salesuse tax changes Effective January 1 2021 King County Sales and use tax within all of King County except for Seattle will increase one-tenth of one percent 001.

For several years the state reduced the commercial rental sales tax rate small amounts with the latest reduction to 55 plus the local surtax effective January 1 2020. Method to calculate Lake County sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The Colorado sales taxrate is 29 the sales tax rates in cities may differ from 325 to 104.

The 2018 United States Supreme Court decision in South Dakota v. Lake County Illinois Sales Tax Rate 2022 Up to 10 Lake County Has No County-Level Sales Tax While many counties do levy a countywide sales tax Lake County does not. The entire combined rate is due on all taxable transactions in that tax jurisdiction.

State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes. The Lake County sales tax rate is 025. Code Local Rate State Rate Combined.

The Lake County Ohio sales tax is 700 consisting of 575 Ohio state sales tax and 125 Lake County local sales taxesThe local sales tax consists of a 125 county sales tax. Download all Florida sales tax rates by zip code The Lake County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Lake County local sales taxesThe local sales tax consists of a 100 county sales tax. 2021 Illinois Sales Tax Rates by County and City ILLINOIS STATE COUNTY CITY SALES TAX RATES 2021 Register Online This page lists an outline of the sales tax rates in Illinois.

November 15 2022 Our office is proceeding with tentative plans to hold a tax sale for delinquent 2021 taxes on November 15 2022. The Lake County Sales Tax is collected by the merchant on all qualifying sales made within Lake County. Tax Rates Effective October 1 - December 31 2021 Note.

Last day to register for the Tax Year 2021 tax sale will be October 31 2022 by 5pm. The December 2020 total local. The City of Rossford in Wood County assesses transit rate of 050 in addition to the posted state and county sales tax rate.

The average sales tax rate in California is 8551. The Ohio state sales tax rate is currently. Location SalesUse Tax CountyCity Loc.

Tax Sale Proceedings Tax sale date for Lake County. Some cities and local governments in Lake County collect additional local sales taxes which can be as high as 25. Contact Us Treasurer Physical Address 18 N County Street Room 102 Waukegan IL 60085 Phone.

Has impacted many state nexus laws and. Some cities and local governments in Lake County collect additional local sales taxes which can be as high as 375. The Illinois sales tax of 625 applies countywide.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. Hopefully this sheds a little light on the tax sale process. Therefore in the example above an additional 89384Non-Business or 31484 and another 22346Owner Occupancy or 7871 RATES OF TAXATION FOR 2021 Payable 2022.

B Three states levy mandatory statewide local add-on sales taxes at the state level. Opry Mills Breakfast Restaurants. The average sales tax rate in Colorado is 6078.

California 1 Utah 125 and Virginia 1. Lake County OR Sales Tax Rate The current total local sales tax rate in Lake County OR is 0000. The minimum combined 2022 sales tax rate for Lake County California is 725.

Lake County California Sales Tax Rate 2022 Up to 875 The Lake County Sales Tax is 025 A county-wide sales tax rate of 025 is applicable to localities in Lake County in addition to the 6 California sales tax. This is the total of state and county sales tax rates.

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

County And Municipal Cannabis Sales Taxes Go Into Effect July 1 The Civic Federation

Florida Sales Tax Information Sales Tax Rates And Deadlines

Local Tax Information City Of Enid Oklahoma

Louisiana Sales Tax Small Business Guide Truic

Sales Tax In Orange County Enjoy Oc

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Florida Sales Tax Rates By City County 2022

This Is The Most Expensive State In America According To Data Best Life

Illinois Sales Tax Rates By City County 2022

Setting Up Sales Tax In Quickbooks Online

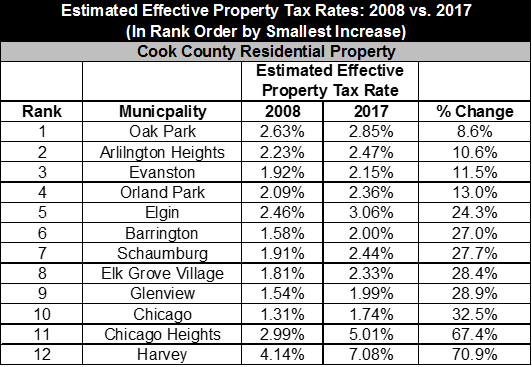

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

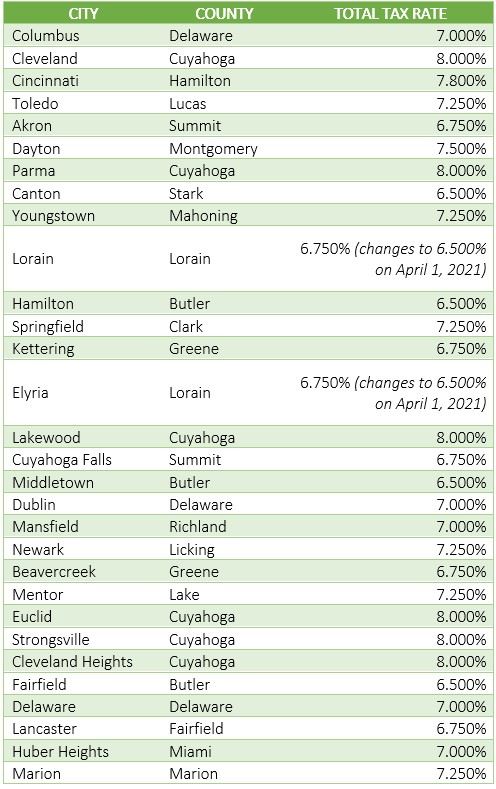

Ohio Sales Tax Guide For Businesses

Arizona Sales Tax Rates By City County 2022

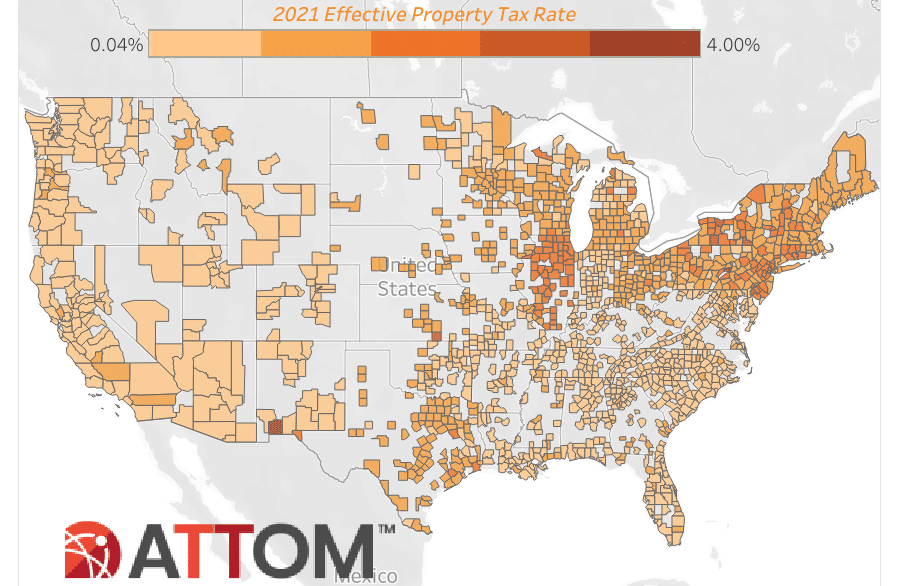

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom